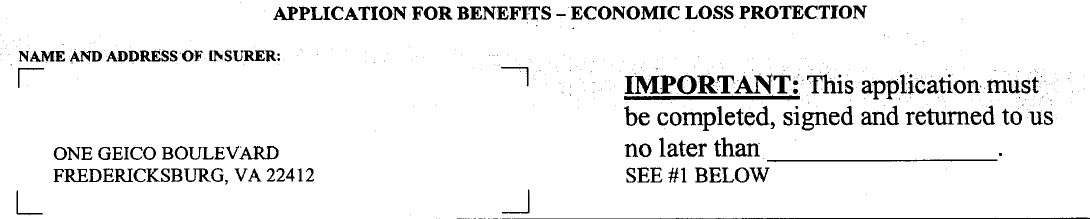

Personal injury protection (PIP) is insurance that comes from the car you are in when you are hurt. It is sometimes referred to as no fault, and if you have PIP coverage it will provide benefits regardless of whether you caused the accident, or the accident was caused by someone else. It is also quick–in most cases, you can start to recover money from a PIP policy within 30 days after you submit the documents to the insurance company. Those documents might include an application, lost wage statements from your supervisor, medical records and medical bills.

How do I know if I have PIP?

In most cases, if you are driving your own car, and you have insurance coverage, your insurance company will provide you with PIP benefits.

Maryland Car Accident Lawyer Blog

Maryland Car Accident Lawyer Blog

Your auto case value is affected by the courts and counties where you are permitted to file the lawsuit. The reason is that (1) some courts have different limits on the amount of money you can recover; and (2), in general, the decision makers (judges and juries) have attitudes toward personal injury cases that makes them more or less likely to give a favorable verdict.

Your auto case value is affected by the courts and counties where you are permitted to file the lawsuit. The reason is that (1) some courts have different limits on the amount of money you can recover; and (2), in general, the decision makers (judges and juries) have attitudes toward personal injury cases that makes them more or less likely to give a favorable verdict.  We’ve discussed how the strength of your case (liability and negligence) affects your case value, and we’ve discussed how the economic damages, like medical bills and lost wages, impacts your case value. Now we’ll talk about non-economic damages.

We’ve discussed how the strength of your case (liability and negligence) affects your case value, and we’ve discussed how the economic damages, like medical bills and lost wages, impacts your case value. Now we’ll talk about non-economic damages.  Probably the most important factor in determining the value of your Maryland auto accident case is the amount and type of economic damages. Economic damages are, simply put, those things which can be calculated with mathematical precision. This is different from non-economic damages (which we’ll talk about next time), which have no universal method of calculation.

Probably the most important factor in determining the value of your Maryland auto accident case is the amount and type of economic damages. Economic damages are, simply put, those things which can be calculated with mathematical precision. This is different from non-economic damages (which we’ll talk about next time), which have no universal method of calculation.  Two major factors in deciding the value of any automobile accident case are liability and damages. Damages, which we’ll discuss in a later post, include things like medical bills, lost wages, pain, suffering and incapacity.

Two major factors in deciding the value of any automobile accident case are liability and damages. Damages, which we’ll discuss in a later post, include things like medical bills, lost wages, pain, suffering and incapacity.  One question common to all Maryland auto accident victims is “what is my case worth?” It’s a simple question with a complicated answer–so complicated, that we’re going to spend the next seven or so blog posts breaking it down for you.

One question common to all Maryland auto accident victims is “what is my case worth?” It’s a simple question with a complicated answer–so complicated, that we’re going to spend the next seven or so blog posts breaking it down for you.

Attorneys are an argumentative bunch. We disagree on many things, so when we agree on something, you should take notice. Something we agree on–don’t give a recorded statement to the insurance company after an automobile collision. It doesn’t matter if it is your insurance company, or the negligent driver’s insurance company.

Attorneys are an argumentative bunch. We disagree on many things, so when we agree on something, you should take notice. Something we agree on–don’t give a recorded statement to the insurance company after an automobile collision. It doesn’t matter if it is your insurance company, or the negligent driver’s insurance company.  Lawyers, like high-pressure used-car salesmen, want you to sign on the dotted line right away. Like all businesspeople, they understand the value of inertia–if you don’t hire them now, then it’s not likely that you’re going to hire them later.

Lawyers, like high-pressure used-car salesmen, want you to sign on the dotted line right away. Like all businesspeople, they understand the value of inertia–if you don’t hire them now, then it’s not likely that you’re going to hire them later.