Talk to your insurance adjuster, raise your PIP

We recommend that all of our clients get as much Personal Injury Protection (PIP) insurance as they can–it’s inexpensive, and it makes a huge difference in your Maryland auto accident case.

We recommend that all of our clients get as much Personal Injury Protection (PIP) insurance as they can–it’s inexpensive, and it makes a huge difference in your Maryland auto accident case.

PIP is a type of no-fault insurance. In exchange for a small premium, it pays medical expenses and a portion of lost wages for the driver, passenger and pedestrians who are in an accident. Because of Maryland’s collateral source rule, auto accident victims can recover for these medical expenses and lost wages twice–once through their own automobile insurance, and once from the negligent driver’s insurance.

Most Maryland insurance policies are set for the default $2,500. That means the most any one person can recover is $2,500 for incurred lost wages and medical expenses. In exchange for slightly (barely perceptible) reduced premiums, drivers can waive PIP (there are very specific rules about the form of the waiver, and improper waivers are ineffective).

Maryland Car Accident Lawyer Blog

Maryland Car Accident Lawyer Blog

Our usual recommendation to people is that when they lease a car, purchase GAP (Guaranteed Auto Protection) insurance. GAP insurance makes up the difference between fair market value of a car and what you owe on the car (the second figure is sometimes higher). This type of insurance is important because in an accident, you are only entitled to the fair market value of the car. The trap is that if you owe more than the Maryland property damage settlement amount, then you certainly won’t have enough money to buy or lease a or new car. Then, you end up renting a car for far too long (which you won’t get completely paid back, either). It’s a terrible cycle of debt, and hard to get out of.

Our usual recommendation to people is that when they lease a car, purchase GAP (Guaranteed Auto Protection) insurance. GAP insurance makes up the difference between fair market value of a car and what you owe on the car (the second figure is sometimes higher). This type of insurance is important because in an accident, you are only entitled to the fair market value of the car. The trap is that if you owe more than the Maryland property damage settlement amount, then you certainly won’t have enough money to buy or lease a or new car. Then, you end up renting a car for far too long (which you won’t get completely paid back, either). It’s a terrible cycle of debt, and hard to get out of.  The Federal government wants to know whether you’ve been texting and driving. They have authorized grants to two states, Connecticut and Massachusetts, for anti-texting enforcement programs. Each state will get $275,000.00.

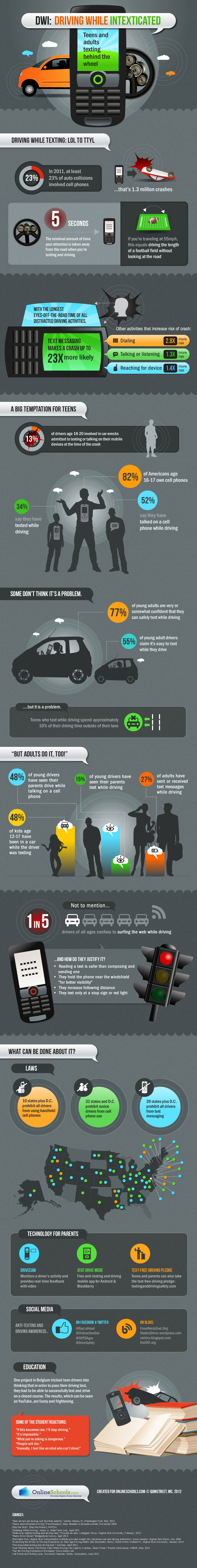

The Federal government wants to know whether you’ve been texting and driving. They have authorized grants to two states, Connecticut and Massachusetts, for anti-texting enforcement programs. Each state will get $275,000.00.  We posted recently about the new law requiring moped and scooter riders to wear helmets, procure insurance and have their vehicles titled (

We posted recently about the new law requiring moped and scooter riders to wear helmets, procure insurance and have their vehicles titled ( With so many accidents caused by distracted driving, it’s a fair bet that, in any given accident, the negligent driver was on a handheld phone or handling e-mail or text messages while driving. In many cases, that fact is not important: if the defendant admits liability, or if liability is clear (for example, the garden variety rear-end collision).

With so many accidents caused by distracted driving, it’s a fair bet that, in any given accident, the negligent driver was on a handheld phone or handling e-mail or text messages while driving. In many cases, that fact is not important: if the defendant admits liability, or if liability is clear (for example, the garden variety rear-end collision).

The New Jersey couple who were hit by a texting driver while riding their motorcycle

The New Jersey couple who were hit by a texting driver while riding their motorcycle  The internet has been in a furor over Progressive’s treatment of a Maryland family following the wrongful death of young woman in an auto accident. Is the furor justified? Check out our Generation J.D. blog post to find out:

The internet has been in a furor over Progressive’s treatment of a Maryland family following the wrongful death of young woman in an auto accident. Is the furor justified? Check out our Generation J.D. blog post to find out: